- 1 Minute to read

- Print

- DarkLight

Configure Foreign Country Withholding Tax (FCWT)

- 1 Minute to read

- Print

- DarkLight

JobBag can now be configured to deduct foreign country withholding tax (FCWT) amounts on both client and supplier invoices.

JobBag has already been configured for withholding tax in the following countries Indonesia, Philippines, Thailand and PNG.

It can also be set up for multiple countries in the one database. You will need to set up each country as a division before you can configure the withholding tax for that country.

Before you start

The country needs to be set up in JobBag

Click here to learn how to set up a new country

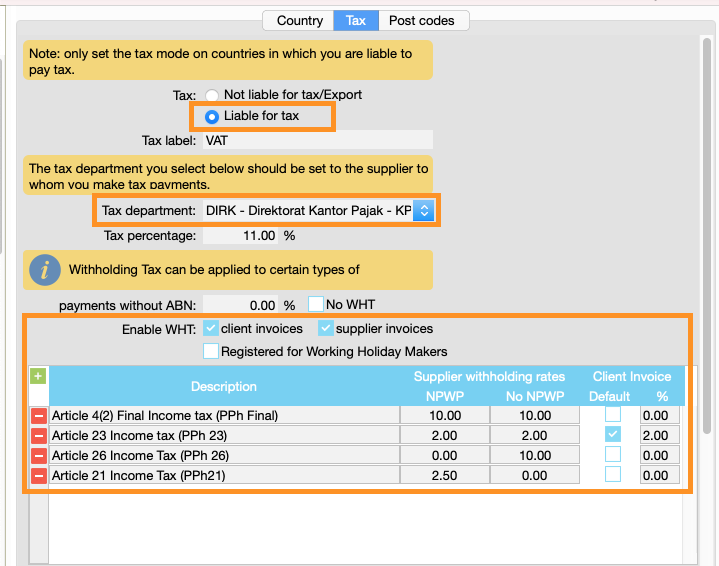

Set up and enable withholding rates in JobBag

Navigate to File > Configuration > Countries

Select and highlight the country > tax tab > select Liable for Tax

Add the tax department. This needs to be set up in the address book

Tick enable WHT: Client invoices/Supplier invoices

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com