Configure PAYG, Talent Rates and Leave Entitlement Default Rates

- 1 Minute to read

- Print

- DarkLight

Configure PAYG, Talent Rates and Leave Entitlement Default Rates

- 1 Minute to read

- Print

- DarkLight

Article summary

Did you find this summary helpful?

Thank you for your feedback!

Overview

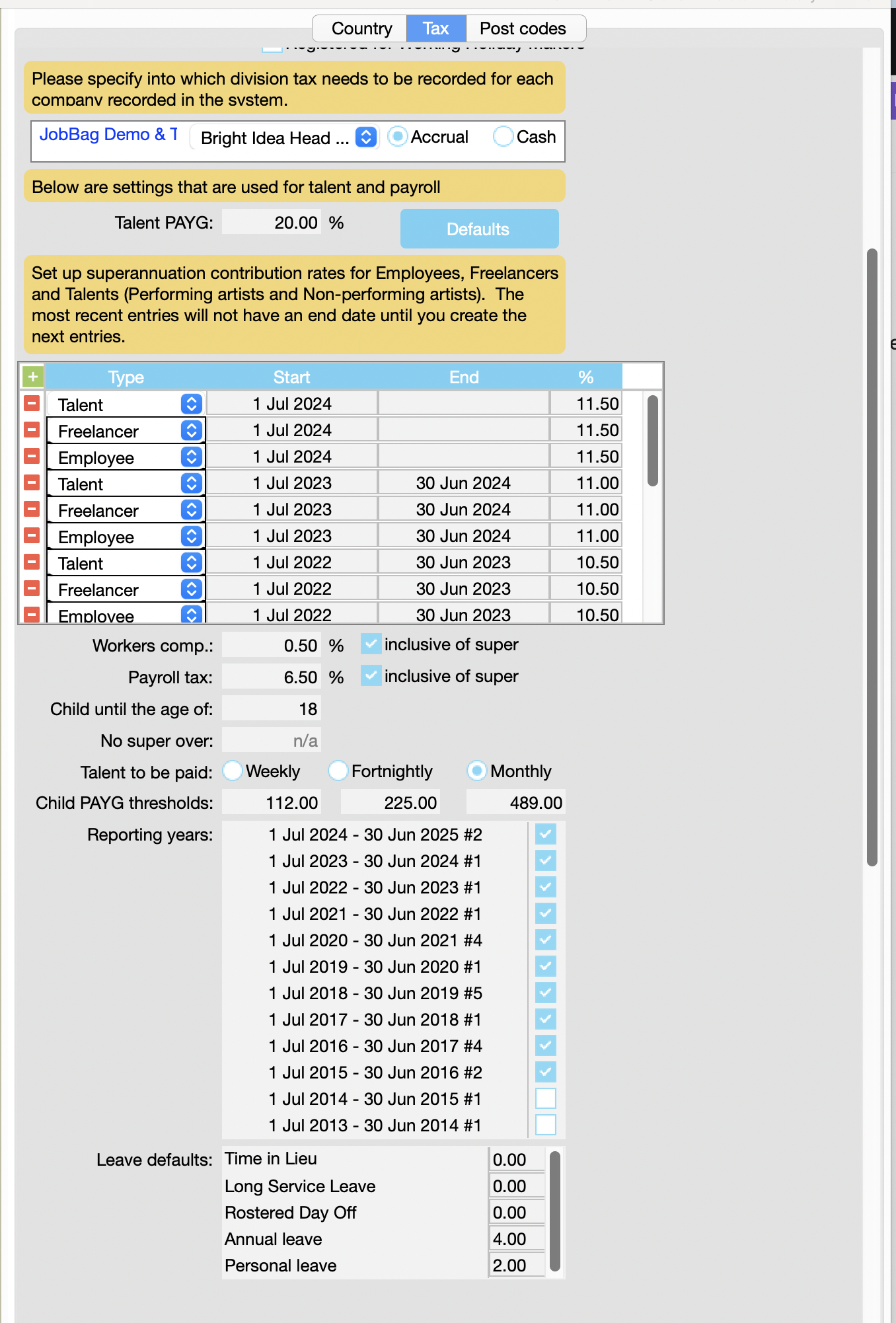

PAYG rates for each year are automatically downloaded. Talent rates, Workers Compensation and Payroll tax rates are entered manually.

Default leave entitlement rates are used to calculate employee's entitlements for annual leave, personal leave and long service leave. If an employee has a different entitlement, these default rates can be overwritten in their personal address book records.

Please complete the following information:

| Field Name | Description |

| Talent PAYG | Enter PAYG rate for TALENT; it is currently at 20% |

| Workers comp: | Enter rate and indicate if it is inclusive of super; this is used in Talent POs to calculate premium payable for talent |

| Payroll Tax | Enter rate and indicate if it is inclusive of super; this is used in Talent Pos to calculate tax payable for talent |

| Child until the age of | Enter 18 - because up to age 18, talent is classified as a child and the PAYG is calculated differently |

| Talent to be paid | Select either weekly or fortnightly or monthly |

| Child PAYG thresholds | Enter information for weekly, fortnightly or monthly |

| Reporting years | this table is updated automatically by JobBag every year |

| Leave defaults | Enter the yearly entitlement for Long Service Leave, Annual Leave and Personal leave |

The default icon - is redundant

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com

Was this article helpful?