- 1 Minute to read

- Print

- DarkLight

How to set up and manage Workers Compensation in JobBag

- 1 Minute to read

- Print

- DarkLight

Use the following process to set up and manage workers' compensation in JobBag for employees who are not working or unable to attend work as required

Workers Compensation set up process

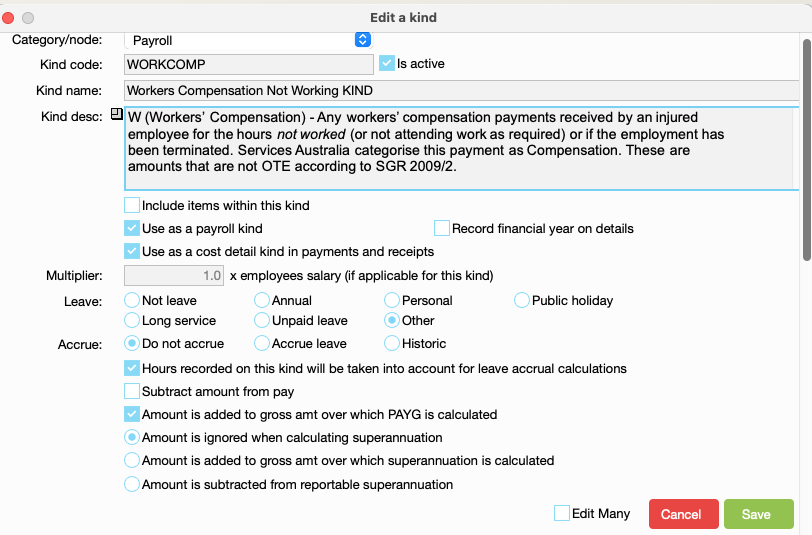

Step 1: Create Payroll kind “Workers Compensation Not working”

Use same settings as below.

PAYG is withheld from Workers Compensation Payments at normal marginal rates.

Superannuation will only accrue on these payments if the employees award (EA) instructs to do so. In the example below, superannuation has not been accrued.

Annual Leave and Long Service Leave is accrued however Personal Leave in most states is not. You may want to consider creating a new employment record and remove Personal leave accrual. Or remove the Personal Leave accrual from the payslip once generated. See below. Please refer to Link to Fair work Act of Accrual of leave entitlements for Workers Compensation

Step 2: Payroll and SBR mapping

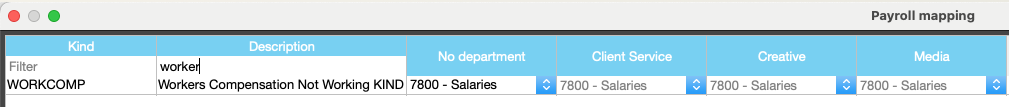

Payroll mapping

In this example I have mapped WORKCOMP to the Salaries expense account.

You may want to consider creating a new balance sheet account and mapping the kind to this account so that you can reconcile and track Workers Compensation payments and receipts.

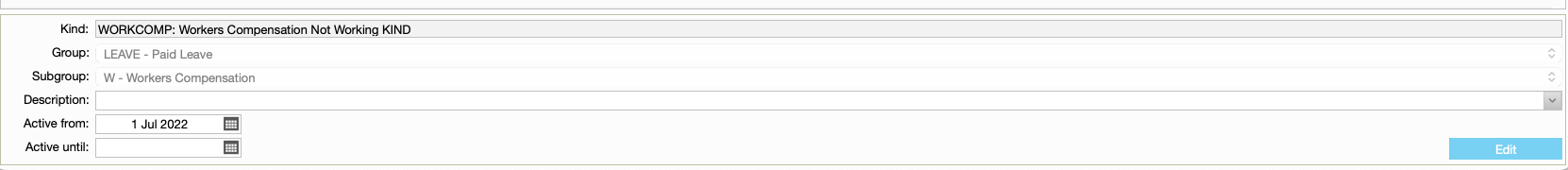

STP Mapping of the payroll kind

The payment is recorded as Paid Leave type W

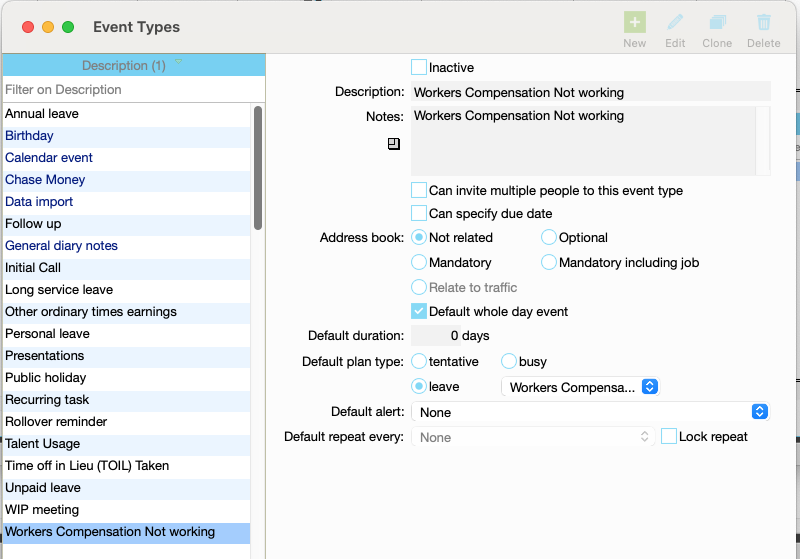

Step 3: Create Event Type

Use the same settings as per below

Workers compensation Payroll process

Step 1: Create a leave event for the period the employee is not working

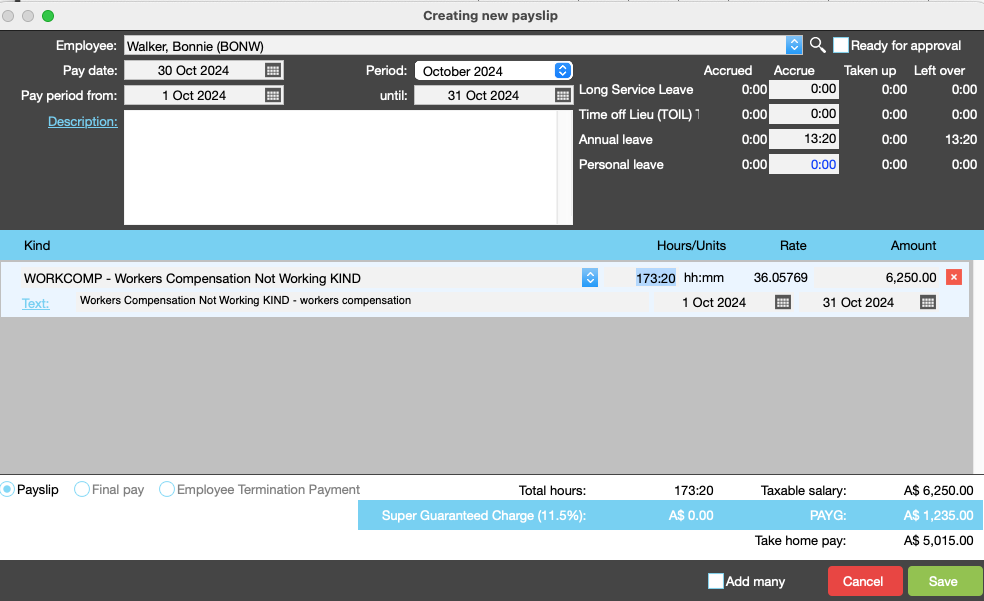

Step 2: Create a Manual Payslip

Remove the Personal Leave Accrual if needed

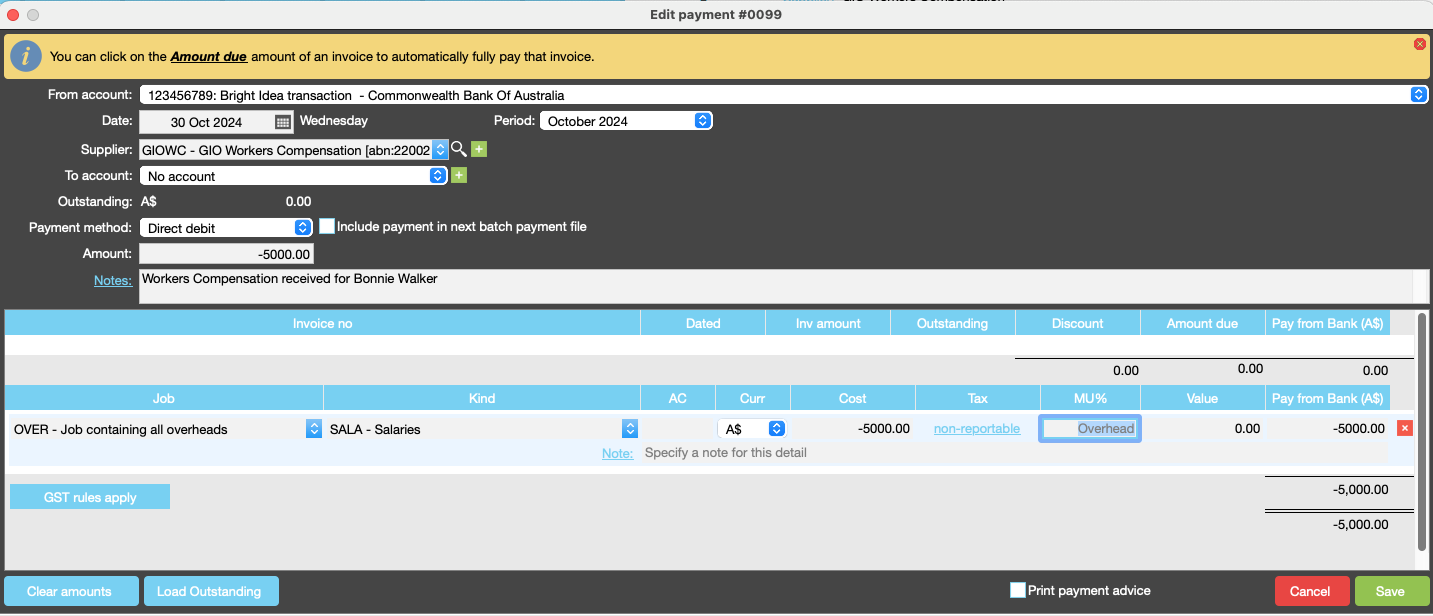

Step 3: Process Receipt from Work Cover

Depending on the option you choose above, when funds are received by work cover you will need to code that receipt to the account mapped in this step.

Need more help?

Please contact support, call 02 8115 8090 or email support@jobbag.com