- 1 Minute to read

- Print

- DarkLight

PAYG Withholding under Voluntary Agreements

- 1 Minute to read

- Print

- DarkLight

PAYG Withholding under a Voluntary agreement can be set up in JobBag for Freelancers, Non performing Artists and Suppliers

Before you start

- You should read the ATO requirements for PAYG Withholding under voluntary agreements See link to the ATO for further information on Voluntary Agreements

- Receive a completed and signed voluntary agreement form along with payers commissioner installment rate, if under 20%

- Please note: In JobBag a voluntary agreement requires both the ABN and TFN of the individual freelancer, non performing artist or supplier

Step 1: Set up Voluntary agreement in JobBag

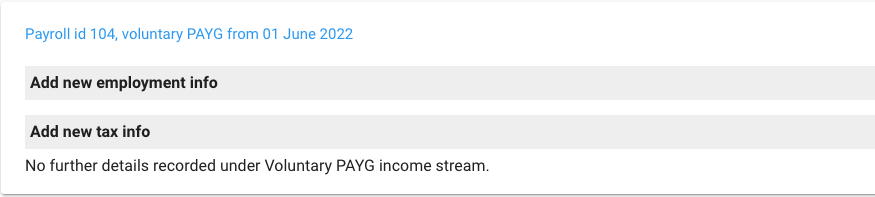

Go to the Employment/PAYG tab, in the freelancer, Non Performing Artist or supplier address book record

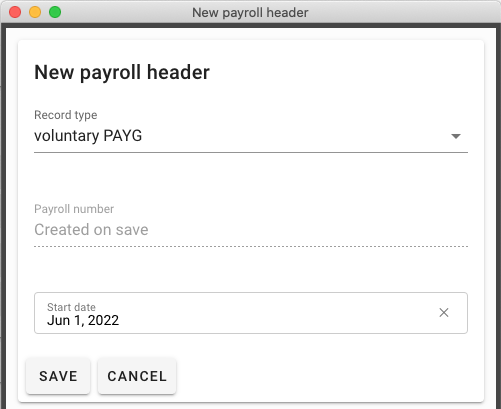

Create a new Voluntary PAYG payroll header

If required, new employment info and tax declaration needs to be completed as per normal

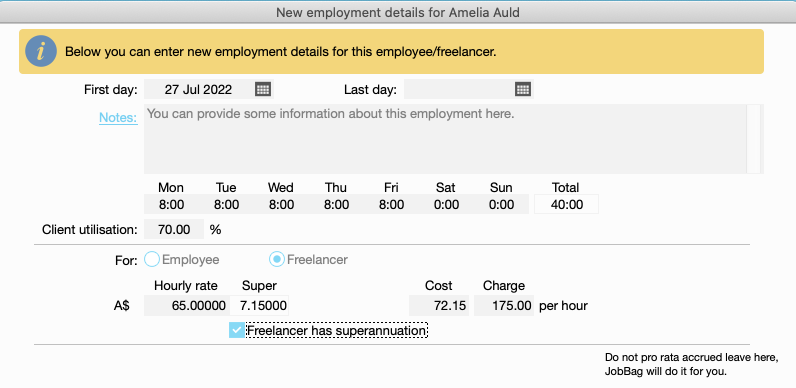

Step 2: Add new employment info

New employment info will need to be entered for freelancers only!

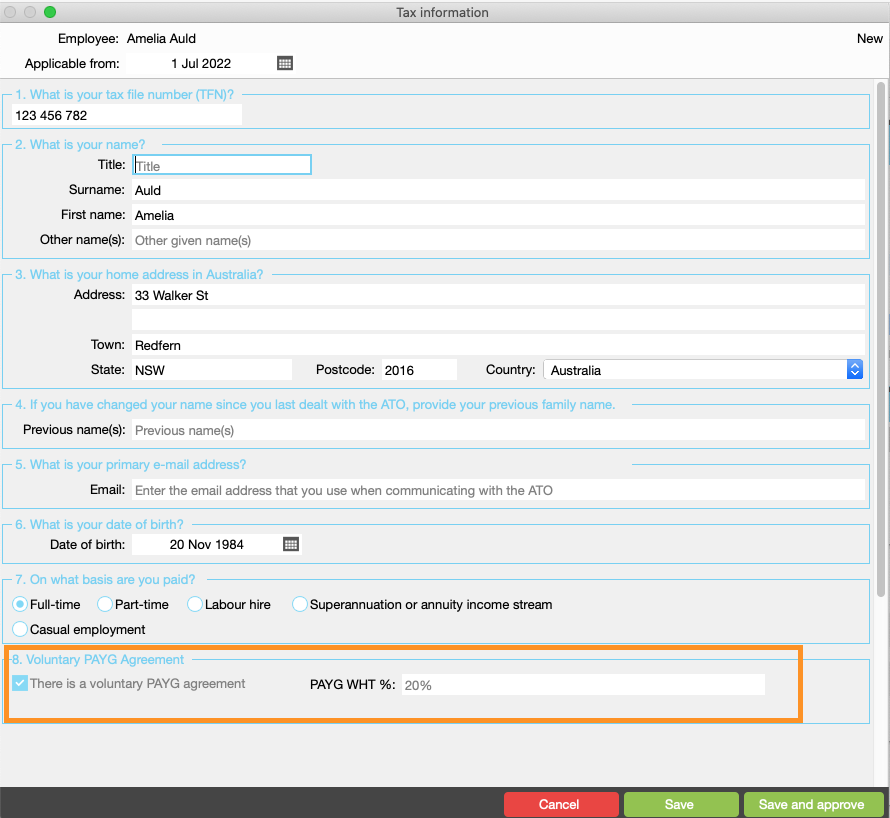

Step 3: Add new tax info

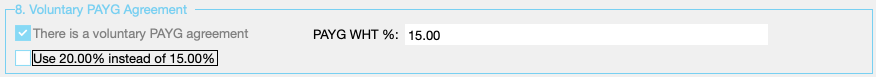

Voluntary PAYG Agreement defaults to 20% but you can enter the commissioner installment rate as provided by the ATO

Enter the commissioner installment rate as provided by the ATO, however the payer can elect to deduct 20%

Need more help?