- 2 Minutes to read

- Print

- DarkLight

Payroll News June 2024

- 2 Minutes to read

- Print

- DarkLight

Welcome to JobBag PAYROLL NEWS for June 2024. Happy End of financial year everyone!

End of year finalisation is due on or before 14 July 2024

The end of year finalisation should be reconciled and submitted to the ATO on or before 14 July 2024.

How to Update YTD and Finalise End of Year with Single Touch Payroll

2024/2025 Tax tables have been published

Theses tax tables include the stage 3 tax cuts and changes to the HELP debt.

When you next log in you will be asked a JobBag question: There are tax tables available for download, do you wish to download them now? Answer "YES"

Or you can update the tax tables in the Payroll menu > Update tax tables. You will get a JobBag notice once the tables have been updated.

Superannuation Increases to 11.50% from 01 July 2024

This has already been updated in the configuration menu.

However a new employment info will need to be created for each employee, see further details below.

If you would like to check and view the new rates you can find them here File > Configuration > Countries > Australia > Tax.

Check out the ATO website for current and future increase

Add New employment info for each employee as at 01 July 2024

This is will add the 11.50% Superannuation Guaranteed Charge to the employment record and increase their overall Salary package amount.

Click here to see how to add new employment info

For employees who have a Salary Package you may need to review the Salary Package and update the salary package line.

Review and update maximum super contribution base

The maximum super contribution base is used to determine the maximum limit on any individual employee's earnings base for each quarter of any financial year. Employers do not have to provide the minimum support for the part of earnings above this limit.

Check out this link to the ATO for information on the maximum contribution base

Click here to learn how to set this up in JobBag

Public Holidays

Just a reminder that public holidays need to be entered into JobBag before you run payroll.

Click here to learn how to Process Public Holidays in JobBag

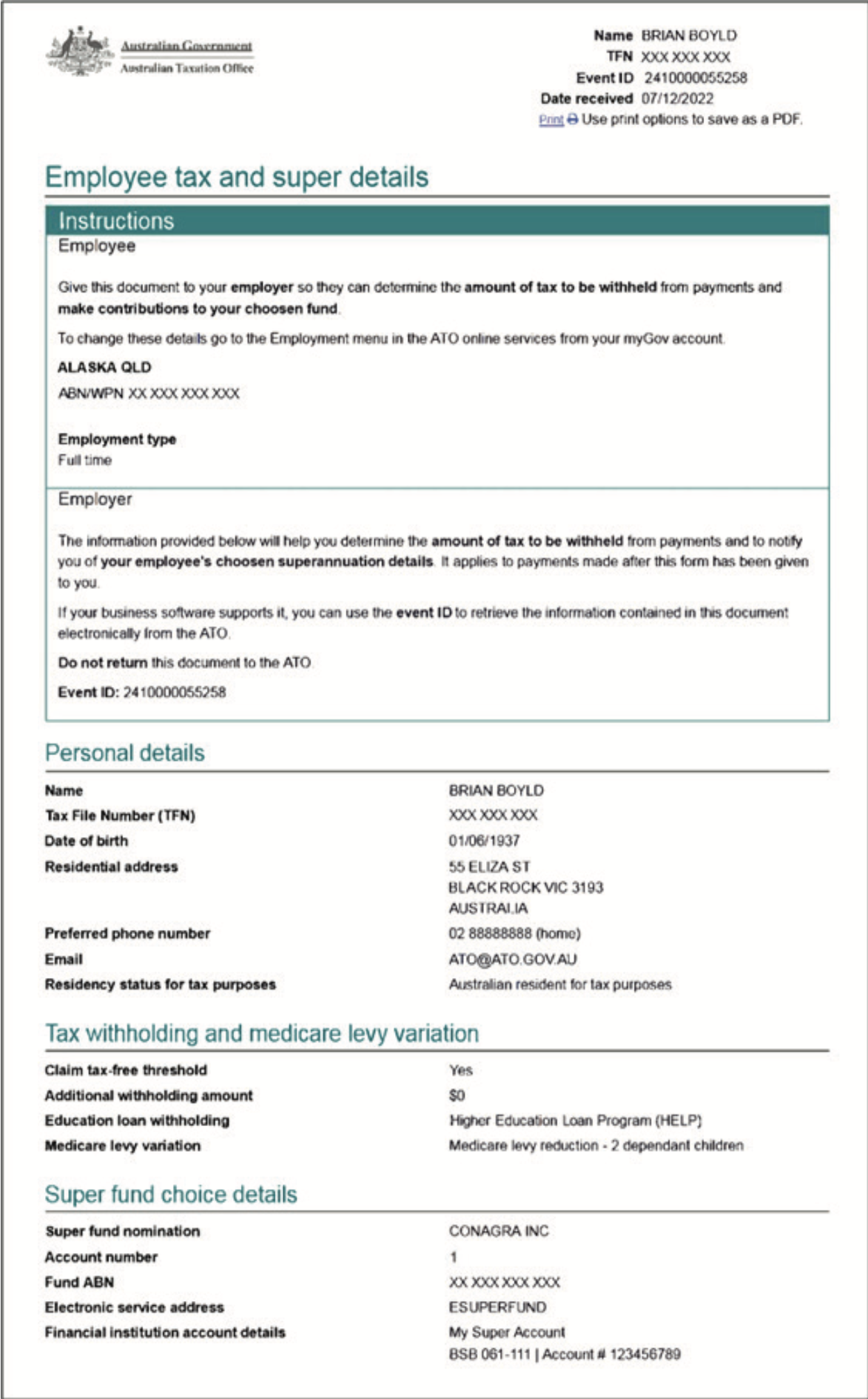

New employee tax and super details

The paper version of the Tax Declaration Form will be phased out and removed from the ATO website by the end of the year.

New employees will need to complete the new employment form in myGov and provide a pdf copy of the form to their employer. See example of the form below.

Click here to see Instructions for Employees to complete New Employment Form using myGov

The Payer/Employer will use the event ID to retrieve the employee's tax and super details. This is available now in JobBag.

Note: The only exception for using the paper TFN Declaration form after 2023 will be for those payees who do not have internet connection and cannot create a myGov account.

Also check out our new employee on boarding checklist

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com