- 1 Minute to read

- Print

- DarkLight

How to set up Withholding Tax for other Countries in a Supplier Record

- 1 Minute to read

- Print

- DarkLight

How to set up withholding tax for other countries in a supplier record

In some Asian countries businesses are required to withhold taxes (WHT) on supplier invoices and client invoices. This is in addition to the GST (VAT or Sales Tax).

If configured you can set up withholding tax for new or existing suppliers.

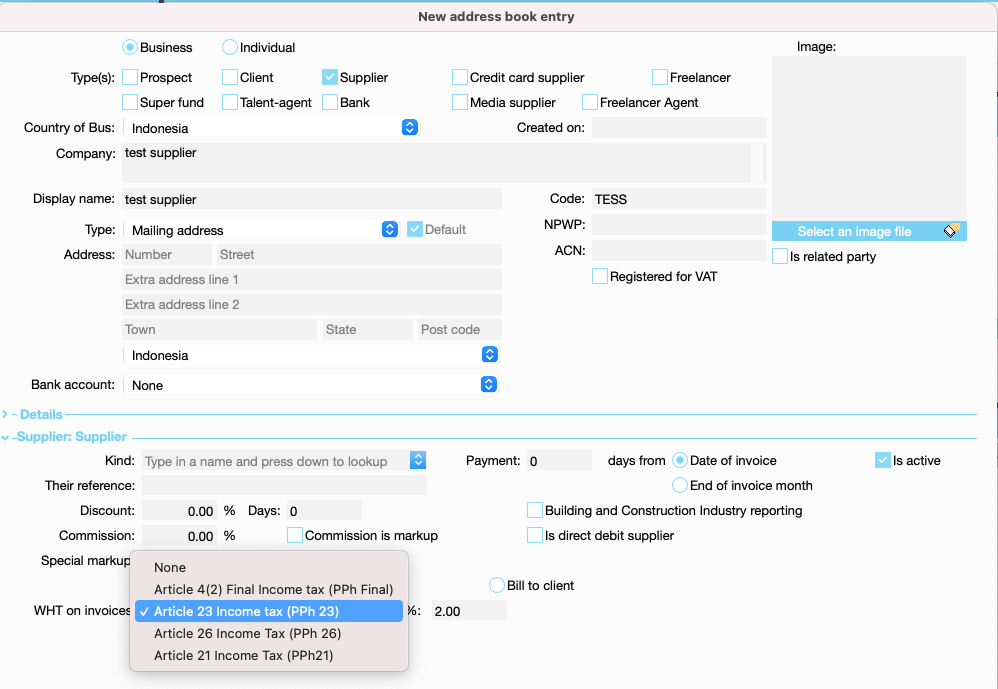

First, navigate to the address book > JobBag menu > Address book > find Supplier worklist

Either create a new supplier or edit an existing record.

Supplier section

In the supplier section Look for WHT on invoices and select one of the rate types from the drop down list.

These are the default tax rates which have been set up in 'countries/tax'.

You can change the tax rate if required

Did this article help you? |